Home Sweet (Vacation) Home

From Rehoboth to Deep Creek Lake, we take a peek at the second-home market.

By Adam Bednar

Illustration by Naomi Elliott

Photography by Christopher Myers

Libby Zay and her husband Raul Soto started looking for homes in 2019, they weren’t ready for a standard-sized house but were instead interested in the so-called “tiny house” movement. While they never found a property in Baltimore that exactly fit that bill, they did find a relatively small property to call home for the next two years.

After Zay’s job changed, the couple bought a full-sized home in the Canton area. But they couldn’t bring themselves to part with their original dwelling—which just happened to be a 1982 Taiwanese CHB Trawler named Valentina, docked along the Canton waterfront. Now they use the boat as a second home.

—Illustration and animation by Naomi Elliott

“It really is like a respite from the city, even though you are still in the city,” Zay says.

Their unconventional second home provides a quaint waterfront atmosphere in a decidedly urban environment. Valentina may not be a ski chalet or beach bungalow, but the 41-year-old fishing boat provides the same benefits of a classic vacation escape. The biggest perk, Zay says, is the boat offers sanctuary from the daily grind. It fosters an atmosphere that helps her unwind and feel like she’s escaped city life, even if she’s only a short distance from her primary residence in Baltimore.

“Being on the boat, even though it’s in the city still, it’s such a relaxing experience. You see a lot more wildlife than you do in your own home,” Zay says.

According to local housing statistics and real estate agents, more Maryland residents like Zay and Soto, both 39, choose to invest in a second residence. But data also shows those dreaming of the perfect getaway may need to embrace nontraditional abodes to afford such a luxury, especially in Maryland’s most popular vacation home markets.

Libby Zay and Raul

Soto relax onboard

Valentina, their

floating “home”

away from home.

COVID-19’S VACATION HOME BONANZA

Ironically, it was COVID-19’s lockdowns that kicked off the vacation home-buying bonanza. In the years since the coronavirus outbreak, office buildings have hemorrhaged tenants. Meanwhile, demand for second homes in Maryland surged as remote working morphed from lockdown necessity to standard operating procedure.

“One of the things that was a big shot in the arm with us is COVID,” says Chuck Mangold, an agent at Benson & Mangold Real Estate in Talbot County on Maryland’s Eastern Shore. “[It] either taught people or enabled people, on a long-term basis, to work from home. [Now] home can be wherever.”

Home being “wherever” means that a family can pile the kids into the minivan to a vacation home but still bring their laptops and work files with them. The ability to take your job on the go has freed people. And this is borne out by statistics. The Bright MLS’s most recent Mid-Atlantic second-home market report shows climbing second-home prices throughout most of 2021, 2022, and the start of 2023. People can now work from anywhere, so why not manage the daily grind from a beachfront condo? Even if you must pay a premium to get there.

Eventually, rising interest rates slowed the market for second homes by the second quarter of 2023. “As soon as interest rates started to hit the eights, the phone stopped ringing. I think a lot of people were fed up with how high rates were going,” says Jay Ferguson of Taylor Made Deep Creek Sales. Despite recent fluctuations, agents say 2024 looks like it will be a robust one for the second-home market.

Perhaps it doesn’t come as a surprise, but data collected in 2023 shows that relatively affluent buyers dominate the local second-home market, which may potentially evolve into an exclusive domain for the state’s wealthiest residents.

While this is good news for those with deep pockets, the dreaded lack of inventory that generally afflicts the housing market makes reasonably priced homes trickier to find.

This is writ large in Talbot County, arguably the Maryland jurisdiction that’s benefited most from a surge in the second-home market. In 2015, Bloomberg News, using a ZIP code that includes the towns of Oxford and St. Michael’s, listed Easton among the nation’s wealthiest small towns. In 2023, Talbot County’s average home price ballooned to $789,471 (up 13 percent from the previous year), surpassing Montgomery County as the jurisdiction with the highest average home price, according to the Maryland Association of Realtors.

But it’s not just prices that have changed. “When I first got into this business almost 25 years ago, the first thing a second-homeowner would ask me when they got in the car and we were going to look at a house, was ‘How deep is the water?’ We very rarely have that anymore. They’re just interested in having a water view,” Mangold says.

Despite data indicating the cost of buying a second home is becoming prohibitive for a large chunk of Maryland residents, agents like Mangold say with a bit of persistence home buyers who aren’t fabulously wealthy can find relatively affordable second or vacation homes in the county.

“Talbot County’s prices have not raised on a percentage basis as much as the beaches and some other resort areas. I think [there is] still a really great opportunity. If you can find one, you can buy a good home here,” Mangold says.

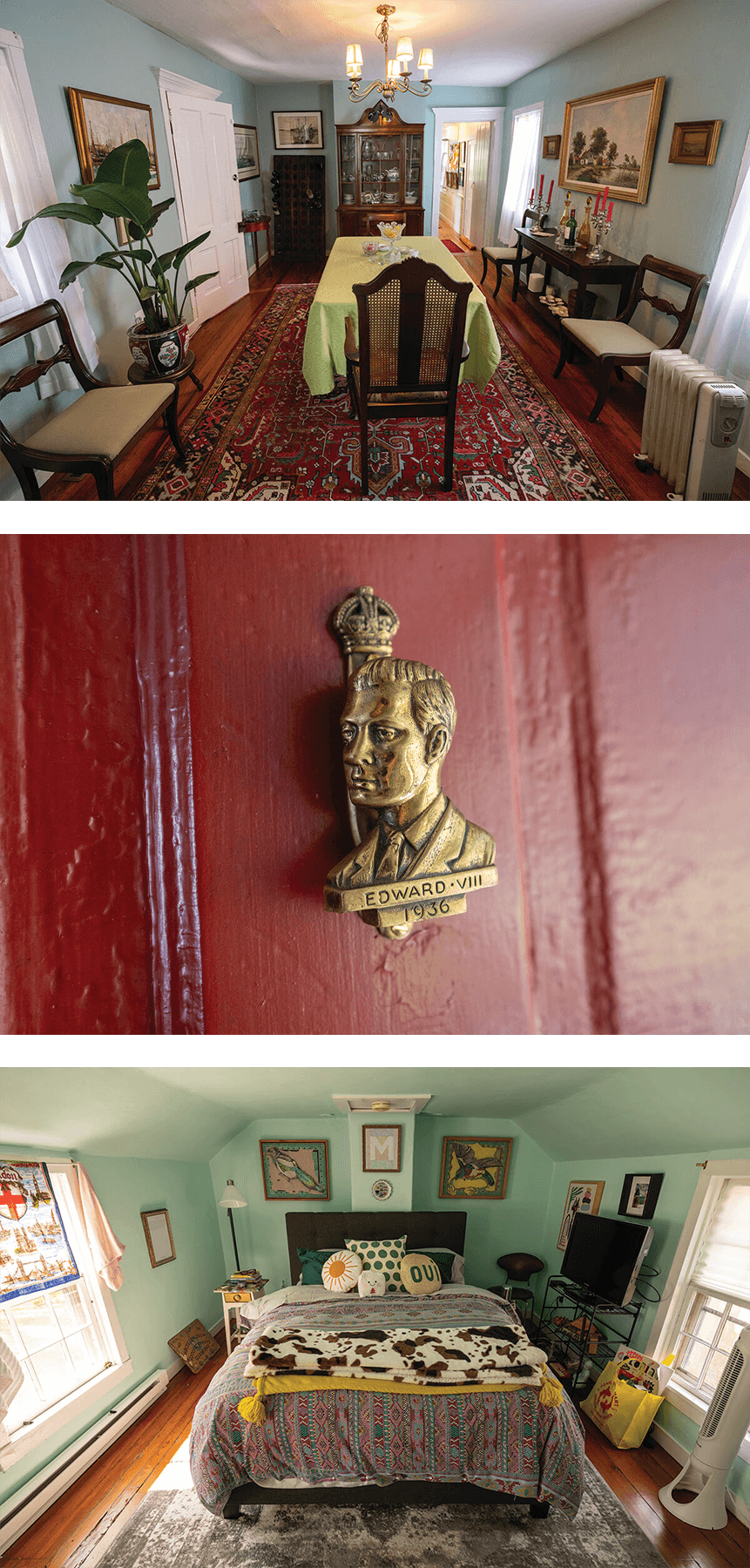

John Marsh, a 53-year-old senior strategist at Mindgrub, is one of Talbot County’s part-time COVID refugees who lucked out in the housing search. He’d recently settled a divorce and wanted to be on the water, a setting he recalled enjoying while growing up near Annapolis.

So, he and his sister, a real estate agent, started looking for a second home he could afford that provided proximity to water and some rustic charm, a place where he could garden and get away from the hustle of city life.

“We saw this house in Royal Oak . . . and it was a house in foreclosure,” Marsh explains. “It’s an old Victorian house, and we went and looked at it, and there was just something about it, where I was like, ‘Okay, I think this is where I want to be right now in my life.’”

John Marsh in his Eastern Shore retreat,

a restored Victorian located in Royal Oak.

LIFESTYLE CHOICES DRIVE DEMAND

Price tags notwithstanding, it’s often the lifestyle afforded by a second home that compels a buyer to take the plunge. And Maryland’s most popular second-home markets—think beaches, mountains, lakes, and the Bay—offer several distinct lifestyle options.

In Western Maryland’s Garrett County, particularly around Deep Creek Lake and Wisp Resort, homeowners want a lifestyle that delivers a shot of adrenaline with an outdoorsy chaser. Homes in that market, agents say, tend to attract buyers enticed by easy access to a host of activities like skiing, mountain biking, and whitewater rafting.

“There are different personality types that come with different seasons,” says Ferguson. “For instance, if somebody’s looking right now, they’re probably a skier, enjoy the snow, enjoy Wisp, and like being outdoors, versus somebody that comes in the spring, maybe they’re a golfer or more oriented toward the lake. Summertime, it’s definitely [the] lake, golf, whitewater rafting—all of the above.”

Elizabeth Miller Reich, 56, and her husband, Greg, 58, had visited the Deep Creek area for years as a couple to ski and dreamed of owning a home in the area. Eventually, they bought a plot of land and had a log cabin built that embodied the cozy rustic feeling they associated with being in the mountains.

“It’s very quiet. At night, you go outside and see tons of stars, and it’s really relaxing. When you spend some time in nature, you just decompress really easily,” Reich says.

Meanwhile, in Ocean City, buyers tend to want a seaside lifestyle. But how they define that lifestyle plays a significant role in whether they want to buy a condo, beachfront bungalow, or bayside trailer.

Summer Forbes, a real estate agent at Coastal Life Realty, explains that many of her clients are okay with being near the beach, even if they can’t be on it. “They want to be able to enjoy [the beach] when they can, and that could be something that isn’t waterfront...maybe they can simply walk 10 minutes to the beach,” Forbes says. “Sometimes it is a full panoramic view of the ocean or the bay because that specific person is just in love with Ocean City’s sunsets. It definitely [depends on] the person.”

Meanwhile, places like Talbot County offer an easygoing atmosphere, ranging from St. Michael’s—with its various restaurants, quaint main-street shopping, and museums—to Oxford’s small-town vibe.

“You can be in a restaurant or a bar, and there’s a guy that probably owns a $12-million house next to a guy that’s a crabber, and they’re having a beer. It’s a weird, strange, cool little town,” Marsh says.

When the idea of owning a second home first pops into a potential buyer’s mind, it starts with fantasies of skiing out the backdoor onto powder-covered slopes or sipping an ice-cold beverage on the porch as the sun settles below the ocean’s horizon.

Pretty soon, those dreams of powder and sunsets are replaced by the stress of finding the right property, navigating the buying process, and fending off the nagging anxiety goblin whispering in your ear, as you try to sleep, “This is a bad idea.”

But real estate agents in some of Maryland’s top second-home markets have suggestions to help keep your mind focused on the possibilities.

SHOP LOCAL

Make sure you are working with a local real estate agent.

Agents working in vacation and second-home markets across Maryland said hiring a local real estate agent is a top priority.

That advice from a real estate agent may come across as self-serving, Chuck Mangold of Benson & Mangold Real Estate admits with a laugh. But there are solid reasons to work with a local when purchasing a second home, he explains. At the top of that list of reasons, Mangold says the agent who helped you buy your primary residence may miss something particular to a jurisdiction or property type.

“There’s a lot of nuances to buying a second home, particularly with the waterfront, that only somebody with good local knowledge can help somebody interpret,” Mangold says.

KNOW YOUR GOAL

Understand what you want to accomplish by buying a second home, agents say.

It’s important to know if you envision the home generating some cash flow or whether it will serve simply as your private getaway. Having that conversation early on with an agent saves time and potential regret from buying a property that doesn’t align with the owner’s goals.

“There are a lot of investors who don’t see the draw of teaching their kid to water ski, or being on the ski slopes for the first time, or [going] fly fishing. They’re just looking at numbers on a piece of paper,” Taylor Made Deep Creek Sales’ Jay Ferguson says.

GET YOUR MONEY RIGHT

Make sure your finances are in order.

Buying a second home may have a few more hoops to jump through than a first-home purchase, like more stringent underwriting requirements and a larger down payment.

Summer Forbes, a real estate agent at Coastal Life Realty, says the first step in preparing to buy a second home is to examine monthly bills, look at your savings—basically break it all down—and ensure you can genuinely afford another property.

“I think the biggest thing is, obviously, organizing your finances and determining what you can comfortably afford...If you need a mortgage, get in touch with those sources you trust to help you get organized,” Forbes says.

RELAX. BREATHE.

Don’t let the size of the purchase freak you out.

Agents say purchasing a second property can seem overwhelming if it’s a new experience. Maybe a buyer hasn’t bought a home in decades and is unsure where to start.

Also, Forbes says that having an agent who has listened to what the buyer wants and understands their needs can help buyers through the steps and cover a good deal of the legwork.

“It’s not as scary a process as you may think it could be just because it is a larger purchase. I think a lot of people get worked up by the unknown...that they’re scared to take that step,” Forbes says.

TO RENT OR NOT TO RENT

Some people buy a second home as an investment, imagining that money will just pour in from renters. Others may hope to—or need to—rent their second home for at least part of the year to defray expenses. But realtors say, not so fast. The reality is more nuanced, and renting comes with benefits and challenges.

Reich says she and her husband initially planned to rent out their recently constructed log cabin near Deep Creek Lake. Reich, an interior designer with Crosby Jenkins (formerly Jenkins Baer), even chose furnishings that not only complemented the cabin’s pine interior and dark stained floors but were durable enough to last in a rental property.

Yet, the day she was moving the furniture into the house was the same day that former Gov. Larry Hogan declared a state of emergency due to COVID-19. As a result, property owners around Deep Creek were barred from renting their homes.

The lockdown also turned the cabin into the Reich family’s primary residence for the next several months, creating a bond with the property that made renting it uncomfortable.

“It just felt like our actual home away from home, and it was really difficult to think of opening it up to renting,” Reich says.

Nearly three years since Hogan declared the state of emergency over, the Reich family is revisiting renting their log cabin, which Country Living magazine featured in its October 2021 issue. At the moment, she says, they’re exploring their options.

“We’re considering renting it in a certain way, like through a boutique rental company that maybe charges a little more of a higher dollar figure. So we know...[guests will] take care of it,” Reich says. While it’s not uncommon for second homeowners in Maryland to offer short-term rentals to offset expenses, the frequency at which owners rent their properties and their expectations regarding income from those rentals largely depends on location.

In Garrett County, which the National Association of Realtors (NAR) ranked seventh in the nation’s top vacation home markets in 2021, many owners choose to rent out their properties. However, Ferguson said he’s upfront with potential owners regarding a property’s cash flow prospects, because rental rates and demand aren’t sufficient to cover a property’s mortgage.

“If somebody uses the word ‘invest,’ I very, very, very quickly pivot to there’s nothing here from a vacation rental standpoint that pays for itself,” he says. “That’s something that I think is the number-one rule. There’s nothing here that’s cash flow positive, nothing.”

In other words, buy a second home in Garrett County because you love it, not because you think it will be a great investment.

Ocean City, however, is another story. Unlike some other parts of Maryland, the potential for rental income from properties at the beach is real. Forbes says that fact has spurred interest from clients shopping for a second home in the area specifically with the idea of renting the property to generate income.

“The conversation I’m having more of is owning a beach home and having it pay for itself. That’s kind of that sweet spot between where you could have one or two weekends blocked off a month [to stay in your second home], but then the remainder of the month rent it out as a short-term rental,” Forbes says. “So that’s definitely more enticing to a lot of people looking to purchase specifically a second home or beach home.”

Meanwhile, in markets like Talbot County, owners purchasing homes to generate rental income are few and far between. The second-home market in that jurisdiction, Mangold says, is primarily about owning a second residence, not additional income.

“One thing we noticed is we’re almost getting away from calling any of these second homes, [and] referring to them as another home,” Mangold says, explaining that owners see it more like having two primary residences.

Back in Baltimore, Zay and Soto plan to list their boat as an Airbnb rental this spring.

They explain that maintenance on a 42-year-old floating second home isn’t particularly cheap. It’s the first time they’ll rent Valentina, Zay says, so they’re unsure how much business they’ll do. They’re hoping for enough additional cash flow to help keep the boat in good shape.

“We can still sleep on it, and we can still take it out if we want to [between rentals]. But we are also making some income...so it’s a win-win for us,” Zay says.

So, if you’re considering a second home, the ultimate rule is: Do your research. Are you looking to buy as a source of income? As a respite? A little of both? Take a deep dive into the numbers and don’t be afraid to ask your real estate agent questions—that’s what they’re there for.

When considering a second home, many potential buyers fixate on the expense of the home balanced against its potential to generate revenue. Yet, Marsh says his second home is a refuge, one that allows him to work from home and be productive if he chooses in this post-pandemic, new-normal world.

“You feel like you have another outlet, another place to go,” says Marsh. “I don’t like using the word ‘stuck.’ But I get a different feeling when I look forward to going to my house on the Eastern Shore.”

OWNING A SECOND HOME

(or any real estate

for that matter) can be a classic story of love—and betrayal. Take your time and don’t fall too hard. Follow these simple tricks and tips and let cooler heads prevail.

- DO read the building bylaws (or HOA rules) before your buy. The no-pet policy, for example, might mean there’s no place for your Great Dane.

- DO rummage through the attic (and closets) of your primary home to see what you already have when outfitting your getaway.

- DON’T be afraid to say, “There’s no room at the inn!” and DO establish boundaries with guests.

- DO think twice before buying a fixer-upper. Remember, you’re supposed to be on vacation.

- DO consider that you might “graduate” to this home when you retire. Accessible first-floor bedrooms and bathrooms are a good idea.

- DO make extra sets of keys so everyone (including guests) can be on their own schedule.

- DO buy a set of used bikes for tooling around, and always keep a yoga mat on hand for stretching and a designated deep-breathing spot (you’ll need it).

- DO keep board games and puzzles around for family togetherness time (and rainy days).

- DON’T buy in the same building as your in-laws (too close for comfort is real).

- DON’T discount at least one futon, a set of bunk beds, or even a Murphy bed to maximize occupancy options. If all else fails, a large air mattress will do.

- DO consider stocking your kitchen with a fun appliance or two—an ice-cream machine or waffle maker, for example—to get into full downtime mode.

- DON’T stress too much—remember that having a second home is a total privilege.

A vacation home means mi casa es su casa.

BY JANE MARION

When we decided to take the plunge and buy a beach home-away-from-home at the Jersey Shore—all 850 square feet of it—we adopted the-more-the-merrier approach. It was one bedroom, one-and-a-half baths, in a circa-1976 building whose tag line was “The Crown Jewel of the Shore.” The year was 2006 and we were a family of five, not including the pets we snuck in despite the building’s bylaws. It was a financial stretch, but we thought it would be a place to create lasting memories and times of togetherness—what used to be called “Kodak moments.”

And together we were. With one queen bed, an air mattress, a futon, a semi-comfortable sofa bed, and a few spare sleeping bags, we slept wherever there was a soft enough place to land. This was our version of camping out, and it was, in its own way, an adventure.

On many a night, we piled into the car—luggage, kids, groceries, cleaning supplies, board games, lacrosse sticks—so that we could then pile into the tiny apartment for the weekend. There was barely enough room for our nuclear family. Still, wanting to share the experience, we welcomed our relatives, friends, and acquaintances for a little sun, surf, and those famed foot-long White House Italian hoagies. We figured since we had gotten adept at cramming into the apartment filled with tacky objects we’d rehomed from our primary residence, another person (or two) made no difference.

What we hadn’t bet on was the sheer number—and audacity—of our guests.

Our getaway was more like a “going toward.” It was close to my husband’s and my hometown of Philadelphia—where most of our extended family and college friends lived—so the opportunities for sleepovers and socializing were endless, even if the square footage was anything but.

And when guests did come—our sisters (with or without a spouse), the occasional niece, our son’s girlfriend-turned-wife, our daughter’s best friend, friends with their kids in tow—I was reminded of my hometown hero Ben Franklin’s old aphorism: “Guests, like fish, begin to smell after three days.” (If I’m being honest, it felt like that after a few hours.)

As they filed in, the laundry piled up, the kitchen sink was never empty, and we made regular runs to the pharmacy because someone inevitably got stung by a jellyfish, forgot to apply sunscreen, or ate too many hot dogs on the boardwalk (before riding the carousel swings on Steel Pier.)

In time, some of our guests wised up and asked if they could use the place even when they weren’t expressly invited. One cousin, who behaved like a contestant on The Bachelor, treated the place like his own “Fantasy Suite” on a regular basis. (He’s still single, but we really wanted the rose to go to the rabbi’s daughter.) And when my sister visited for “a week or two” but stayed for several seasons, I found myself researching squatter’s rights. (I did not evict her in the name of sisterly love.)

Is it any wonder I sometimes daydreamed about going back to the peace and quiet of our house in Baltimore, which now sounded more like a vacation home than our actual vacation home?

The thing about having a place to escape is that you never really do. As the years went on, we were there less and less, largely just by circumstance—our kids had sports to play, parties to attend, and academic obligations at home. My husband and I had property owner headaches and HOA fees that suddenly felt like a waste of money.

Like everything in life, the upside of a downside is the lessons we learn: Whether it’s sun, drinks on the deck, or air mattresses in constant rotation, too much of anything—even beachfront real estate—isn’t a good thing. So, after a decade, we sold the apartment.

Two years later, the apartment was on the market again. It was still 850 square feet, but the barely there dining room was turned into a bedroom (a Zillow search showed a sturdy bunk bed), and the half-bathroom became a full. With these new and improved renovations, I’m sure someone got a great return on their investment. Plus, now there’s more room for guests.